Federal Tax Form 2023 Basic Personal Amount . Here’s how that works for a single person earning $58,000. 2023 tax rates for a single taxpayer. You have to pay tax for the year. You want to claim the canada workers benefit (cwb) and. For a single taxpayer, the rates are: Starting 2023, the federal basic personal amount is based on your net income for the year. File a 2023 return if: Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable income of $15,000 in 2023 without paying any. The purpose of the bpa is to. You want to claim a refund. The maximum basic personal amount you can. The basic personal amount (bpa) before enhancement is $13,521 for 2023, increased by indexation to $14,156 for 2024.

from www.youtube.com

For a single taxpayer, the rates are: The basic personal amount (bpa) before enhancement is $13,521 for 2023, increased by indexation to $14,156 for 2024. 2023 tax rates for a single taxpayer. The purpose of the bpa is to. You want to claim the canada workers benefit (cwb) and. You want to claim a refund. The maximum basic personal amount you can. Here’s how that works for a single person earning $58,000. Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable income of $15,000 in 2023 without paying any. Starting 2023, the federal basic personal amount is based on your net income for the year.

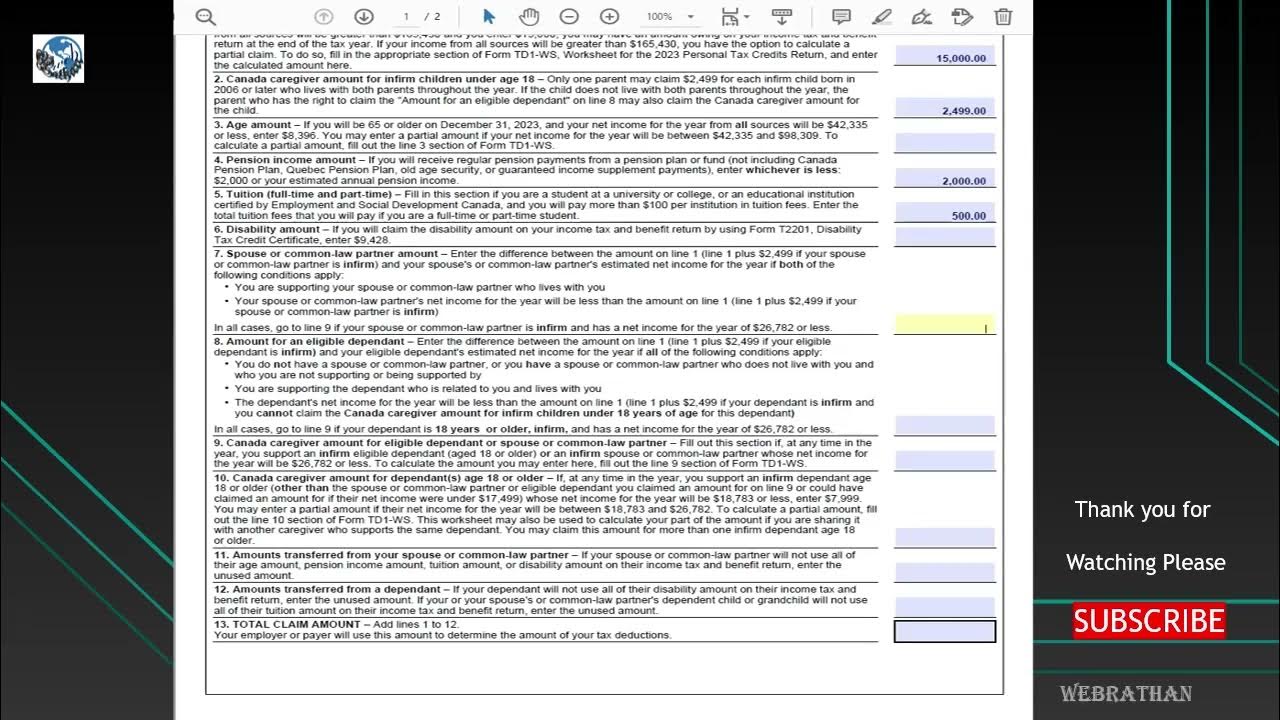

How To Fill TD1 2023 Personal Tax Credits Return Form Federal YouTube

Federal Tax Form 2023 Basic Personal Amount Here’s how that works for a single person earning $58,000. File a 2023 return if: You want to claim the canada workers benefit (cwb) and. Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable income of $15,000 in 2023 without paying any. The basic personal amount (bpa) before enhancement is $13,521 for 2023, increased by indexation to $14,156 for 2024. 2023 tax rates for a single taxpayer. The purpose of the bpa is to. You want to claim a refund. Here’s how that works for a single person earning $58,000. For a single taxpayer, the rates are: The maximum basic personal amount you can. You have to pay tax for the year. Starting 2023, the federal basic personal amount is based on your net income for the year.

From rayjasmine.pages.dev

2024 Tax Forms 2024 Sr 2024 Form Tobey Augustina Federal Tax Form 2023 Basic Personal Amount The basic personal amount (bpa) before enhancement is $13,521 for 2023, increased by indexation to $14,156 for 2024. The purpose of the bpa is to. For a single taxpayer, the rates are: You have to pay tax for the year. 2023 tax rates for a single taxpayer. Starting 2023, the federal basic personal amount is based on your net income. Federal Tax Form 2023 Basic Personal Amount.

From www.employementform.com

Selfemployment Tax Form Pdf 2022 Employment Form Federal Tax Form 2023 Basic Personal Amount You want to claim a refund. Starting 2023, the federal basic personal amount is based on your net income for the year. You want to claim the canada workers benefit (cwb) and. 2023 tax rates for a single taxpayer. The purpose of the bpa is to. Every taxpayer gets a tax credit for the basic personal amount, so any person. Federal Tax Form 2023 Basic Personal Amount.

From www.canada.ca

Completing a basic tax return Learn about your taxes Canada.ca Federal Tax Form 2023 Basic Personal Amount You want to claim a refund. Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable income of $15,000 in 2023 without paying any. You want to claim the canada workers benefit (cwb) and. File a 2023 return if: For a single taxpayer, the rates are: Here’s how that works for a single. Federal Tax Form 2023 Basic Personal Amount.

From printableformsfree.com

Pa Local Tax Form 2023 Printable Forms Free Online Federal Tax Form 2023 Basic Personal Amount 2023 tax rates for a single taxpayer. For a single taxpayer, the rates are: The maximum basic personal amount you can. Starting 2023, the federal basic personal amount is based on your net income for the year. The purpose of the bpa is to. You want to claim the canada workers benefit (cwb) and. Every taxpayer gets a tax credit. Federal Tax Form 2023 Basic Personal Amount.

From fillableforms.net

Fillable 2023 W 2 Forms Fillable Form 2024 Federal Tax Form 2023 Basic Personal Amount File a 2023 return if: Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable income of $15,000 in 2023 without paying any. The purpose of the bpa is to. Here’s how that works for a single person earning $58,000. You want to claim the canada workers benefit (cwb) and. You want to. Federal Tax Form 2023 Basic Personal Amount.

From www.marca.com

Form 5695 Which renewable energy credits apply for the 2023 tax Federal Tax Form 2023 Basic Personal Amount Starting 2023, the federal basic personal amount is based on your net income for the year. File a 2023 return if: Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable income of $15,000 in 2023 without paying any. You want to claim the canada workers benefit (cwb) and. Here’s how that works. Federal Tax Form 2023 Basic Personal Amount.

From 8962-form-printable.org

IRS Form 8962 for 2023 ⮚ Printable 8962 Tax Form & Free Fillable Federal Tax Form 2023 Basic Personal Amount You want to claim the canada workers benefit (cwb) and. Here’s how that works for a single person earning $58,000. The purpose of the bpa is to. You want to claim a refund. Starting 2023, the federal basic personal amount is based on your net income for the year. The basic personal amount (bpa) before enhancement is $13,521 for 2023,. Federal Tax Form 2023 Basic Personal Amount.

From www.pdffiller.com

2023 Form Canada TD1AB E Alberta Fill Online, Printable, Fillable Federal Tax Form 2023 Basic Personal Amount Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable income of $15,000 in 2023 without paying any. You want to claim a refund. For a single taxpayer, the rates are: Starting 2023, the federal basic personal amount is based on your net income for the year. The basic personal amount (bpa) before. Federal Tax Form 2023 Basic Personal Amount.

From www.taxguidenilesh.com

Big update Tax New ITR forms for AY 20232024 (FY 20222023 Federal Tax Form 2023 Basic Personal Amount You want to claim the canada workers benefit (cwb) and. The basic personal amount (bpa) before enhancement is $13,521 for 2023, increased by indexation to $14,156 for 2024. The maximum basic personal amount you can. Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable income of $15,000 in 2023 without paying any.. Federal Tax Form 2023 Basic Personal Amount.

From www.mercer.com

2023 Social Security, PBGC amounts and projected covered compensation Federal Tax Form 2023 Basic Personal Amount You want to claim a refund. 2023 tax rates for a single taxpayer. Starting 2023, the federal basic personal amount is based on your net income for the year. You have to pay tax for the year. The basic personal amount (bpa) before enhancement is $13,521 for 2023, increased by indexation to $14,156 for 2024. Every taxpayer gets a tax. Federal Tax Form 2023 Basic Personal Amount.

From www.vrogue.co

How To Fill Out A Form 1040 Youtube vrogue.co Federal Tax Form 2023 Basic Personal Amount File a 2023 return if: You have to pay tax for the year. 2023 tax rates for a single taxpayer. The basic personal amount (bpa) before enhancement is $13,521 for 2023, increased by indexation to $14,156 for 2024. You want to claim the canada workers benefit (cwb) and. Here’s how that works for a single person earning $58,000. The purpose. Federal Tax Form 2023 Basic Personal Amount.

From printableformsfree.com

2023 Irs Tax Chart Printable Forms Free Online Federal Tax Form 2023 Basic Personal Amount 2023 tax rates for a single taxpayer. File a 2023 return if: For a single taxpayer, the rates are: You want to claim a refund. Here’s how that works for a single person earning $58,000. You want to claim the canada workers benefit (cwb) and. The basic personal amount (bpa) before enhancement is $13,521 for 2023, increased by indexation to. Federal Tax Form 2023 Basic Personal Amount.

From www.youtube.com

How To Fill TD1 2023 Personal Tax Credits Return Form Federal YouTube Federal Tax Form 2023 Basic Personal Amount Starting 2023, the federal basic personal amount is based on your net income for the year. The purpose of the bpa is to. You have to pay tax for the year. You want to claim the canada workers benefit (cwb) and. For a single taxpayer, the rates are: The maximum basic personal amount you can. Here’s how that works for. Federal Tax Form 2023 Basic Personal Amount.

From printableformsfree.com

5695 Form 2023 Printable Forms Free Online Federal Tax Form 2023 Basic Personal Amount The maximum basic personal amount you can. The purpose of the bpa is to. For a single taxpayer, the rates are: You want to claim the canada workers benefit (cwb) and. Here’s how that works for a single person earning $58,000. 2023 tax rates for a single taxpayer. You have to pay tax for the year. File a 2023 return. Federal Tax Form 2023 Basic Personal Amount.

From www.taxuni.com

1040 Form 2023 Federal Tax Form 2023 Basic Personal Amount 2023 tax rates for a single taxpayer. You want to claim the canada workers benefit (cwb) and. The purpose of the bpa is to. The basic personal amount (bpa) before enhancement is $13,521 for 2023, increased by indexation to $14,156 for 2024. The maximum basic personal amount you can. Here’s how that works for a single person earning $58,000. You. Federal Tax Form 2023 Basic Personal Amount.

From printableformsfree.com

W 4 2023 Printable Form Printable Forms Free Online Federal Tax Form 2023 Basic Personal Amount Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable income of $15,000 in 2023 without paying any. The purpose of the bpa is to. Starting 2023, the federal basic personal amount is based on your net income for the year. You want to claim the canada workers benefit (cwb) and. You have. Federal Tax Form 2023 Basic Personal Amount.

From www.youtube.com

IRS Form 8879 walkthrough (IRS efile Signature Authorization) YouTube Federal Tax Form 2023 Basic Personal Amount 2023 tax rates for a single taxpayer. The basic personal amount (bpa) before enhancement is $13,521 for 2023, increased by indexation to $14,156 for 2024. You have to pay tax for the year. You want to claim the canada workers benefit (cwb) and. Every taxpayer gets a tax credit for the basic personal amount, so any person can earn taxable. Federal Tax Form 2023 Basic Personal Amount.

From lusaloreen.pages.dev

Alberta Provincial Tax Forms 2024 Eyde Odella Federal Tax Form 2023 Basic Personal Amount For a single taxpayer, the rates are: File a 2023 return if: The purpose of the bpa is to. Here’s how that works for a single person earning $58,000. Starting 2023, the federal basic personal amount is based on your net income for the year. You want to claim a refund. The maximum basic personal amount you can. Every taxpayer. Federal Tax Form 2023 Basic Personal Amount.